[Posted by Prof Henry G. Overman]

I've spent a lot of time over the last seven years (since SERC was founded) thinking about how urban economics can help improve urban policy. As part of that, I've helped specific cities and LEPs develop their evidence base and think about policy implementation (particularly Manchester, but also North East LEP, Birmingham, Great Cambridge / Greater Peterborough). I've also provided advice to BIS and Cabinet Office on the implementation of City Deals.

Recently, however, I've had an opportunity to move beyond this urban focus to think about the challenges facing the 'non-mets': the places outside our metropolitan areas that produce roughly half of England's GDP. The challenges these places face, and some of the potential solutions, are discussed in the interim report of the Independent Commission on Economic Growth and the Future of Public Services in Non-Metropolitan England (I'm one of the commissioners).

We're working on refining our recommendations over the next couple of months. As the report makes clear - there are some big questions still to answer - not least about how we might reform the relationship between central and (non-metropolitan) local government. I know that many people would like to see wholesale reform in this area. But there's also the possibility of an 'earned autonomy' model for non-mets that would parallel the process that has seen Manchester the first of the mets to be handed stronger powers (with Leeds, Sheffield and perhaps others to follow). I imagine many heated debates to come as we try to resolve this and a range of other crucial questions. Do get in touch with the commission [nonmet_commission@local.gov.uk] if you'd like to know how you can contribute to those discussions.

Monday, 24 November 2014

Tuesday, 11 November 2014

Building homes where we need them

Finally had a chance to catch-up with Centre for Cities report on where to build homes for Britain's most successful cities.

In the ten least affordable (British) cities building out every brownfield site delivers a total of 425,000 extra houses. If you go outside of their existing built-up area and use land within 25 minute walk of an existing train station you could add up to 1.4 million new homes (at reasonable densities). If neighbouring authorities could be made to cooperate that total rises to 3.4 million homes within 2 km of existing train stations.

The trouble, of course, is that those 3.4 million homes (within walking distance of existing infrastructure) would need to be built on green-belt land. In total, around 12.5% of the green belt land around those cities would be needed for development.

Achieving agreement on this scale of development on green belt land will clearly be difficult. Although, as the report notes, developing brownfield land can be a complex process and may require cities to take additional actions (e.g. land assembly) and investment (e.g. new infrastructure). And that brownfield land is only capable of delivering a fraction of the homes that could be built around existing infrastructure in the greenbelt.

In short, as the report makes clear, both options have their challenges, but making housing more affordable in our most successful cities will require a more sensible debate to designate land on its merits rather than according to whether it is currently designated as brown or green field.

In the ten least affordable (British) cities building out every brownfield site delivers a total of 425,000 extra houses. If you go outside of their existing built-up area and use land within 25 minute walk of an existing train station you could add up to 1.4 million new homes (at reasonable densities). If neighbouring authorities could be made to cooperate that total rises to 3.4 million homes within 2 km of existing train stations.

The trouble, of course, is that those 3.4 million homes (within walking distance of existing infrastructure) would need to be built on green-belt land. In total, around 12.5% of the green belt land around those cities would be needed for development.

Achieving agreement on this scale of development on green belt land will clearly be difficult. Although, as the report notes, developing brownfield land can be a complex process and may require cities to take additional actions (e.g. land assembly) and investment (e.g. new infrastructure). And that brownfield land is only capable of delivering a fraction of the homes that could be built around existing infrastructure in the greenbelt.

In short, as the report makes clear, both options have their challenges, but making housing more affordable in our most successful cities will require a more sensible debate to designate land on its merits rather than according to whether it is currently designated as brown or green field.

Monday, 10 November 2014

Who buys new homes in London?

There's some interesting figures in this British Property Federation report from earlier this year on purchases of new homes in London (which I somehow missed first time round).

Headline figure is that various forms of investor acquire around 60% of new units with owner occupiers taking 40%. Around half of those investor purchases are by overseas buyers (defined as buyers who are normally registered as overseas). There's little evidence that those overseas buyers are leaving properties empty.

There are interesting variations across price ranges and locations - with owner occupiers acquiring around 80% of sub £450 per square foot properties (mostly in outer London) but only around 30% of £1,000-£1,500 per square foot properties (mostly in inner and 'prime' central London).

Overseas buyer activity varies by location as well - accounting for 50% of prime, 20% of inner London and only 7% of outer London (I think this is totals of investors and owner occupiers).

As always, figures from the property industry come with a big fat health warning (there's lots of private data and expert adjustments in use here) but I still found the overall numbers interesting - and a useful counter point to some of the media reporting which suggests much more overseas buyer activity.

Headline figure is that various forms of investor acquire around 60% of new units with owner occupiers taking 40%. Around half of those investor purchases are by overseas buyers (defined as buyers who are normally registered as overseas). There's little evidence that those overseas buyers are leaving properties empty.

There are interesting variations across price ranges and locations - with owner occupiers acquiring around 80% of sub £450 per square foot properties (mostly in outer London) but only around 30% of £1,000-£1,500 per square foot properties (mostly in inner and 'prime' central London).

Overseas buyer activity varies by location as well - accounting for 50% of prime, 20% of inner London and only 7% of outer London (I think this is totals of investors and owner occupiers).

As always, figures from the property industry come with a big fat health warning (there's lots of private data and expert adjustments in use here) but I still found the overall numbers interesting - and a useful counter point to some of the media reporting which suggests much more overseas buyer activity.

Monday, 27 October 2014

Can 'Tech North' take off?

Posted by Dr Max Nathan, SERC and NIESR

Rory Cellan-Jones has a nice article on the BBC website on the prospects for the Government’s ‘Tech North’ initiative, building extensively from my work with Emma Vandore on Tech City in London. Here’s some further thoughts.

Tech North was launched by Nick Clegg last week: it’s one of the products of the DPM’s recent Northern Futures initiative. The idea is to promote tech clusters in Liverpool, Manchester, Sheffield, Leeds and Newcastle: Clegg has put £2m/year on the table to support local firms, and to attract FDI to the area.

Politically this is a no brainer. It meshes with the government’s ‘rebalancing’ rhetoric. And it fits the new mission of TechCity UK, which has expanded its remit from just East London to cover the whole country. TCUK is publishing work next month looking at digital clusters, which will put some new numbers behind the policy.

*

So will it work? Rory is fairly sceptical in his piece. I’m still unclear what the programme will actually do: so here are five issues policymakers should be thinking about.

1/ Real geographies – Tech North connects five big cities with over 150 miles between them. In the real world, urban tech is in very tight microclusters: neighbourhood scale scenes which allow for lots of face to face contact. In Liverpool, for example, a lot of the action is in Ropewalks or the Baltic Triangle.

In London, Ministers originally hoped to ‘connect’ the Shoreditch cluster to the Olympic Park a few miles away. That hasn’t proved possible, not least because Old Street firms didn’t want to move there and saw no connection between the two.

So the chances of creating a single super hub across the Pennines are slim at best. There are worrying echoes of the Thames Gateway here: a planning concept, not a real place. On the other hand, as we found in London, the area branding might prove a helpful way to raise the profile of these local scenes.

2/ Who’s in and who’s out? The DPM seems to have focused his attention on the five Northern core cities. Fair enough, in that these are the economic powerhouses of their wider regions. But the real geography of tech activity is a little different. But cities like York and Sunderland also have quite a lot of tech firms. So why aren’t they included?

3/ FDI versus growing our own – firms cluster because co-location makes sense: they can tap into new ideas and pools of skilled workers and can share useful inputs (like fast broadband or VC investors). On the other hand, as Henry Overman and I have argued, clusters have tensions built in. As more firms enter, pressures on space build up, so rents rise. And competition rises, for staff and for market share.

Given all this, it’s risky to base cluster development policies on foreign investment. If FDI simply brings in big multinationals, these might displace smaller, younger UK businesses. Even if this raises aggregate productivity, I doubt it's what Government or cities want in this case. Agencies like UKTI typically try and maximise the count and size of foreign investments. A different approach is needed here, which is to focus on the type of foreign inputs.

4/ Infrastructures – specifically FDI programmes should try and enrich the rest of the ecosystem, especially specialist services tech firms need: finance, lawyers, accountants and workspaces. This stuff is only just starting to appear in London at scale, and is likely to be a priority for other UK cities. Certainly, the UK’s VC scene has been pretty weak outside the capital.

Equally, fast internet (and fast connection to it) is a basic need. For me, this is now a public utility, so it’s disappointing that the Superconnected Cities scheme has retreated from rolling out faster systems to everyone, to simply providing vouchers to SMEs. The CORE programme in York, Peterborough and Derby is an interesting exception (thanks to Tom Forth for the link).

5/ Policy architecture (and whether it really matters) – cluster policy advocates like Michael Porter assume that cluster development has to be local, since clusters are local phenomena. But this doesn’t follow.

First, Tech North has little cash on the table: strikingly, its five-city budget is about the same as the original budget for East London.

Second, a lot of the relevant policy levers are held at national level: tax breaks for investors, crowdfunding regulation, immigration and skills. That still leaves some local levers: branding, networking, planning and any local investment pots. But it’s limited stuff.

Arguably some of these national levers should be devolved: that’s started to happen through City Deals and Local Growth Deals. But we’re at the very start of this process, and though the post-Scotland moment may yet shake things up further, what Ministers are handing over in powers they’re largely taking away in cuts.

But perhaps that’s too pessimistic. As Emma and I found in the East London research, the Old St scene grew quietly for years without policymakers really noticing. That could well be the likely trajectory for the many clusters under the Tech North umbrella.

Originally posted on the squareglasses blog.

Rory Cellan-Jones has a nice article on the BBC website on the prospects for the Government’s ‘Tech North’ initiative, building extensively from my work with Emma Vandore on Tech City in London. Here’s some further thoughts.

Tech North was launched by Nick Clegg last week: it’s one of the products of the DPM’s recent Northern Futures initiative. The idea is to promote tech clusters in Liverpool, Manchester, Sheffield, Leeds and Newcastle: Clegg has put £2m/year on the table to support local firms, and to attract FDI to the area.

Politically this is a no brainer. It meshes with the government’s ‘rebalancing’ rhetoric. And it fits the new mission of TechCity UK, which has expanded its remit from just East London to cover the whole country. TCUK is publishing work next month looking at digital clusters, which will put some new numbers behind the policy.

*

So will it work? Rory is fairly sceptical in his piece. I’m still unclear what the programme will actually do: so here are five issues policymakers should be thinking about.

1/ Real geographies – Tech North connects five big cities with over 150 miles between them. In the real world, urban tech is in very tight microclusters: neighbourhood scale scenes which allow for lots of face to face contact. In Liverpool, for example, a lot of the action is in Ropewalks or the Baltic Triangle.

In London, Ministers originally hoped to ‘connect’ the Shoreditch cluster to the Olympic Park a few miles away. That hasn’t proved possible, not least because Old Street firms didn’t want to move there and saw no connection between the two.

So the chances of creating a single super hub across the Pennines are slim at best. There are worrying echoes of the Thames Gateway here: a planning concept, not a real place. On the other hand, as we found in London, the area branding might prove a helpful way to raise the profile of these local scenes.

2/ Who’s in and who’s out? The DPM seems to have focused his attention on the five Northern core cities. Fair enough, in that these are the economic powerhouses of their wider regions. But the real geography of tech activity is a little different. But cities like York and Sunderland also have quite a lot of tech firms. So why aren’t they included?

3/ FDI versus growing our own – firms cluster because co-location makes sense: they can tap into new ideas and pools of skilled workers and can share useful inputs (like fast broadband or VC investors). On the other hand, as Henry Overman and I have argued, clusters have tensions built in. As more firms enter, pressures on space build up, so rents rise. And competition rises, for staff and for market share.

Given all this, it’s risky to base cluster development policies on foreign investment. If FDI simply brings in big multinationals, these might displace smaller, younger UK businesses. Even if this raises aggregate productivity, I doubt it's what Government or cities want in this case. Agencies like UKTI typically try and maximise the count and size of foreign investments. A different approach is needed here, which is to focus on the type of foreign inputs.

4/ Infrastructures – specifically FDI programmes should try and enrich the rest of the ecosystem, especially specialist services tech firms need: finance, lawyers, accountants and workspaces. This stuff is only just starting to appear in London at scale, and is likely to be a priority for other UK cities. Certainly, the UK’s VC scene has been pretty weak outside the capital.

Equally, fast internet (and fast connection to it) is a basic need. For me, this is now a public utility, so it’s disappointing that the Superconnected Cities scheme has retreated from rolling out faster systems to everyone, to simply providing vouchers to SMEs. The CORE programme in York, Peterborough and Derby is an interesting exception (thanks to Tom Forth for the link).

5/ Policy architecture (and whether it really matters) – cluster policy advocates like Michael Porter assume that cluster development has to be local, since clusters are local phenomena. But this doesn’t follow.

First, Tech North has little cash on the table: strikingly, its five-city budget is about the same as the original budget for East London.

Second, a lot of the relevant policy levers are held at national level: tax breaks for investors, crowdfunding regulation, immigration and skills. That still leaves some local levers: branding, networking, planning and any local investment pots. But it’s limited stuff.

Arguably some of these national levers should be devolved: that’s started to happen through City Deals and Local Growth Deals. But we’re at the very start of this process, and though the post-Scotland moment may yet shake things up further, what Ministers are handing over in powers they’re largely taking away in cuts.

But perhaps that’s too pessimistic. As Emma and I found in the East London research, the Old St scene grew quietly for years without policymakers really noticing. That could well be the likely trajectory for the many clusters under the Tech North umbrella.

Originally posted on the squareglasses blog.

Friday, 3 October 2014

Agglomeration Economies

[Posted by Prof Henry G. Overman]

I've been reading some of the recent material from the Foresight project on cities. In particular, I've been looking at the interesting piece by Ron Martin, Ben Gardiner and Peter Tyler on the long run economic growth performance of UK cities.

While there's much of interest in this paper, there are also a few things that puzzle me - and this blog is about one of them. Specifically, I'm puzzled by the suggestion that ("the New Neoclassical") Urban Economics predicts a positive link between size and economic growth. Or, as the paper puts it: "It is often argued that larger cities confer greater economies of agglomeration and increasing returns effects, and that, holding other things constant, these effects make for faster growth: in other words, that city size, agglomeration and growth form a process of circular and cumulative causation."

To my mind, this 'prediction' is muddling growth and levels. There is a large body of theoretical and empirical literature that suggests that, everything else equal, productivity will be higher in larger cities. It's also true that this literature supports the idea that initial shocks might be magnified by cumulative causation as the urban system adjusts to the shock. So, for example, a city experiencing a positive productivity shock might see a long run effect that is larger than the initial shock (as it attracts more workers and firms). This cumulative causation would, however, run its course once the city had adjusted. In the real world, this could show up as faster 'growth' over a number of years for a city experiencing a positive (productivity) shock.

However, when we switch to long run growth - i.e. to truly dynamic processes that may take place over decades - the link to size is much weaker both theoretically and empirically. Indeed, while some theoretical papers suggest a positive link, there's a growing empirical literature that suggests there may be no relationship. In particular, starting with a paper by Xavier Gabaix in the Quarterly Journal of Economics there's been considerable interest in whether Gibrat's law - which says that there is no link between city size and growth - explains the tendency of city systems to follow Zipf's law (a power law that links the relative size of cities). In an early empirical contribution to this literature, myself and Yannis Ioannides provided evidence to suggest that cities in the US system do indeed follow Gibrat's law. More recently, I've done work with Sabine D'Costa which suggests that for the UK there is very little evidence of any link from city size to wage growth (even thought there is a strong link for wage levels).

In short, the idea that there is no link between city growth and city size is a fairly mainstream 'neoclassical' position - and one that would reflect my own reading of the empirical literature (and indeed some of my own empirical work). So it's surprising to see the lack of a link between size and long run growth presented as somehow presenting a challenge to urban economists like myself.

Part of the muddle here, I suspect, comes in the translation to policy discussions where there has been a tendency to conflate growth and levels effects. I've personally tried to avoid doing this in my policy orientated writings. For example, our work for the Manchester Independent Economic Review was concerned with the productivity advantage that Manchester had relative to the wider region - but this was a statement about levels not growth rates. But it's an easy slip to make when discussing complex issues but trying to use non-technical language.

All of this also raises the much more important question of the implications for urban policy. At any point in time, the urban system is likely to have some large cities that are doing well and some that are doing badly (both in terms of growth and levels). The same is true for small and medium size cities. This reminds us that basing policy on size, per-se, isn't very sensible unless size correlates with some other important considerations - e.g. governance. This is why, for example, some of us pushed very hard to have the second round of English city deals focus on some of the smaller cities that were fast growing rather than just focusing on the (next ten) biggest cities.

But neither does the lack of a link suggest that we should completely ignore the issue of size. If, for example, the government wants to have a northern city to act as a counterbalance to London then it may make sense to focus investment in a place (e.g. Manchester) that is relatively large and has relatively high productivity. The hope would then be that agglomeration economies might generate a cumulative causation process that helped further the positive impact of that investment. Whether this would happen in practice depends on the extent to which policy can generate productivity increases, whether congestion costs increase quickly or slowly, etc. If it was successful, the effects would show up as faster growth for Manchester in the short to medium run, but (as the data make clear) not necessarily in the long run.

So the link between size, productivity and growth does matter for policy, even if - as seems likely - there is not a strong link between city size and long run growth.

I've been reading some of the recent material from the Foresight project on cities. In particular, I've been looking at the interesting piece by Ron Martin, Ben Gardiner and Peter Tyler on the long run economic growth performance of UK cities.

While there's much of interest in this paper, there are also a few things that puzzle me - and this blog is about one of them. Specifically, I'm puzzled by the suggestion that ("the New Neoclassical") Urban Economics predicts a positive link between size and economic growth. Or, as the paper puts it: "It is often argued that larger cities confer greater economies of agglomeration and increasing returns effects, and that, holding other things constant, these effects make for faster growth: in other words, that city size, agglomeration and growth form a process of circular and cumulative causation."

To my mind, this 'prediction' is muddling growth and levels. There is a large body of theoretical and empirical literature that suggests that, everything else equal, productivity will be higher in larger cities. It's also true that this literature supports the idea that initial shocks might be magnified by cumulative causation as the urban system adjusts to the shock. So, for example, a city experiencing a positive productivity shock might see a long run effect that is larger than the initial shock (as it attracts more workers and firms). This cumulative causation would, however, run its course once the city had adjusted. In the real world, this could show up as faster 'growth' over a number of years for a city experiencing a positive (productivity) shock.

However, when we switch to long run growth - i.e. to truly dynamic processes that may take place over decades - the link to size is much weaker both theoretically and empirically. Indeed, while some theoretical papers suggest a positive link, there's a growing empirical literature that suggests there may be no relationship. In particular, starting with a paper by Xavier Gabaix in the Quarterly Journal of Economics there's been considerable interest in whether Gibrat's law - which says that there is no link between city size and growth - explains the tendency of city systems to follow Zipf's law (a power law that links the relative size of cities). In an early empirical contribution to this literature, myself and Yannis Ioannides provided evidence to suggest that cities in the US system do indeed follow Gibrat's law. More recently, I've done work with Sabine D'Costa which suggests that for the UK there is very little evidence of any link from city size to wage growth (even thought there is a strong link for wage levels).

In short, the idea that there is no link between city growth and city size is a fairly mainstream 'neoclassical' position - and one that would reflect my own reading of the empirical literature (and indeed some of my own empirical work). So it's surprising to see the lack of a link between size and long run growth presented as somehow presenting a challenge to urban economists like myself.

Part of the muddle here, I suspect, comes in the translation to policy discussions where there has been a tendency to conflate growth and levels effects. I've personally tried to avoid doing this in my policy orientated writings. For example, our work for the Manchester Independent Economic Review was concerned with the productivity advantage that Manchester had relative to the wider region - but this was a statement about levels not growth rates. But it's an easy slip to make when discussing complex issues but trying to use non-technical language.

All of this also raises the much more important question of the implications for urban policy. At any point in time, the urban system is likely to have some large cities that are doing well and some that are doing badly (both in terms of growth and levels). The same is true for small and medium size cities. This reminds us that basing policy on size, per-se, isn't very sensible unless size correlates with some other important considerations - e.g. governance. This is why, for example, some of us pushed very hard to have the second round of English city deals focus on some of the smaller cities that were fast growing rather than just focusing on the (next ten) biggest cities.

But neither does the lack of a link suggest that we should completely ignore the issue of size. If, for example, the government wants to have a northern city to act as a counterbalance to London then it may make sense to focus investment in a place (e.g. Manchester) that is relatively large and has relatively high productivity. The hope would then be that agglomeration economies might generate a cumulative causation process that helped further the positive impact of that investment. Whether this would happen in practice depends on the extent to which policy can generate productivity increases, whether congestion costs increase quickly or slowly, etc. If it was successful, the effects would show up as faster growth for Manchester in the short to medium run, but (as the data make clear) not necessarily in the long run.

So the link between size, productivity and growth does matter for policy, even if - as seems likely - there is not a strong link between city size and long run growth.

Tuesday, 9 September 2014

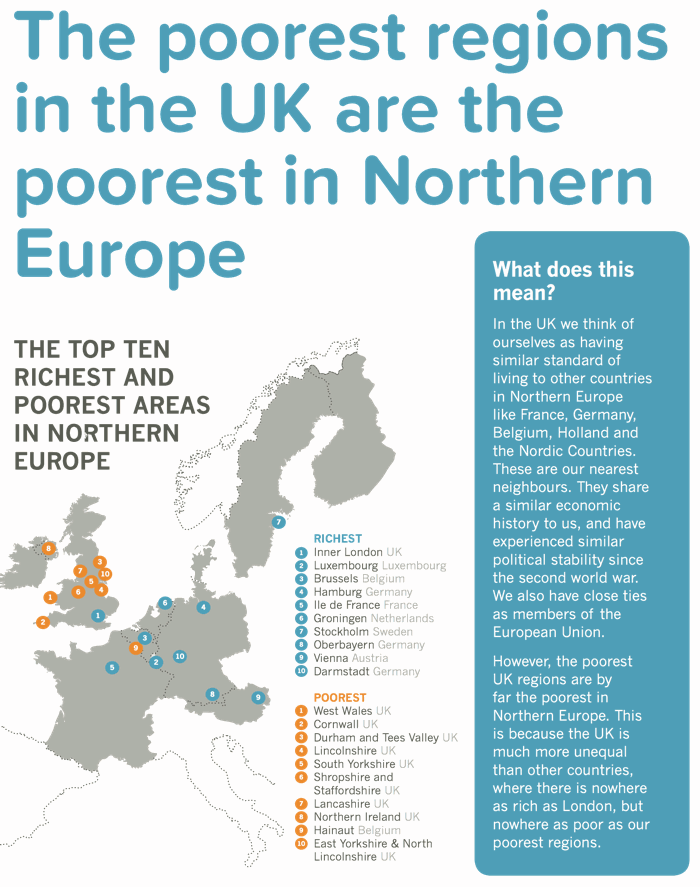

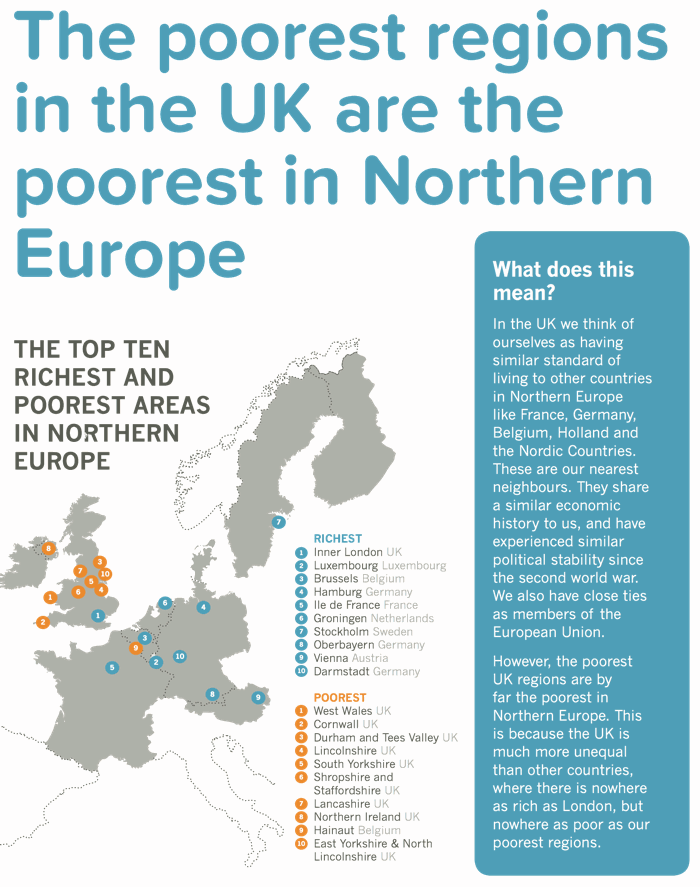

Why are the poorest regions in the UK the poorest regions in Northern Europe?

[Posted by Prof Henry G. Overman]

A few weeks ago the map below showed up in my twitter stream. It had been retweeted hundreds of times. At the time, I meant to write a post on the numbers behind the map. In particular, I wanted to take issue with what it tells us. According to the side bar: "The poorest UK regions are by far the poorest in Northern Europe. This is because the UK is much more unequal than all other countries, where there is nowhere as rich as London, but nowhere as poor as our poorest neighbours"

You can read this statement in two ways. One is simply providing the description of the map - we have very rich and poor regions so we are unequal. The other is to view it causally - the fact that we have high inequality explains why we have the poorest regions in Northern Europe. Unfortunately, the underlying numbers raise questions about both these interpretations (although the second one is particularly problematic).

Let's start with the claim that 'there is nowhere in Northern Europe that is as rich as London'. Unfortunately, this is not what the map shows. The map shows that INNER London has the highest GDP per capita calculated (on a PPS basis). This is three times the UK average. I find it worrying that people think this figure could possibly be correct. Of course, it's not for reasons that are a little, but not very, technical.

To see why this is a problem you need to know a little about how these statistics are calculated and something about the slightly weird geography of EU NUTS2 regions (on which the map is based). The GDP per capita figures allocate output on a workplace basis but population on a residence basis

The crucial issue is that Inner London is an administrative construct, not an economic one. That means that there is lots of commuting across the border of Inner London and, as the original data source makes very clear, "in some regions the GDP per capita figures can be significantly influenced by commuter flows. Net commuter inflows in these regions push up production to a level that could not be achieved by the resident active population on its own". That explains why the London figure looks so crazily high - because it ignores all the commuters who help produce inner London's output.

This is a bigger issue for Inner London than for some other rich EU areas. For example, according to the EU data that are used for this map, London has a population of 3m. In contrast, the Ile de France region has a population of 11m. All of this means that sensible comparisons need to correct for commuting - which I'll do the easy way by simply averaging Inner and outer London. This puts it on a par with Paris (at around 180% of the EU average) but below Luxembourg, Brussels and Hamburg. Of course, some of those regions probably need correcting to - but my point is that the data vastly overestimates London's income - and that you'd want to take account of that before reaching conclusions that 'nowhere is as rich as London'.

Next, is it the case that the UK is much more unequal than all other countries on this map? Here, the answer from the academic literature is that we are certainly more unequal. Whether we are much more unequal is open to debate. Regardless, does this level of inequality explain why the UK has the poorest 10 regions in this selection of Northern countries? It plays a part, but so too does the fact that we also have the lowest average GDP per capita (on a PPS basis). Indeed, the UK average level of income would rank it lower than the poorest Swedish region, poorer than all but a handful of Austrian, Finnish, Danish and Dutch regions (I count 6 in total) without any need to take in to account the level of inequality. In short we have lots of regions in the bottom 10 because we have both lower average income and higher inequality. There's no clean answer as to how much of this map is explained by low average income versus higher inequality. You could think of ways to try to get at it - taking, say, the level of inequality in other countries and applying it to the UK - but you certainly can't identify the separate role of average income and inequality on the basis of the map alone.

If you want an analogy, this is little like taking a primary school, finding that the ten smallest kids are in year one and attributing this to inequality amongst five year olds. [I'd be surprised to see hundreds of people retweeting that study].

One final issue is the use of GDP per capita in PPS. As the statistical note states: "GDP does not measure the income ultimately available to private households in a region" so I am not quite sure in what sense the map even shows 'poorest' and 'richest' regions. Worse, the PPS calculation is done at national, not local level. So this comparison is on nominal not real standards of living - so completely ignores the fact that London is a very expensive city relative to most other EU regions (including those in the UK).

In short, the map is a pretty misleading visual aid. Of course, we all use these kind of tricks to get people talking about important issues (like spatial disparities in the UK). The danger here, however, is that an awful lot of people (some of whom should know better) seem to take this map as showing that 1) London is the richest region in the EU; 2) High inequality explains why we have the poorest regions in Northern Europe. Unfortunately it does nothing of the kind.

A few weeks ago the map below showed up in my twitter stream. It had been retweeted hundreds of times. At the time, I meant to write a post on the numbers behind the map. In particular, I wanted to take issue with what it tells us. According to the side bar: "The poorest UK regions are by far the poorest in Northern Europe. This is because the UK is much more unequal than all other countries, where there is nowhere as rich as London, but nowhere as poor as our poorest neighbours"

You can read this statement in two ways. One is simply providing the description of the map - we have very rich and poor regions so we are unequal. The other is to view it causally - the fact that we have high inequality explains why we have the poorest regions in Northern Europe. Unfortunately, the underlying numbers raise questions about both these interpretations (although the second one is particularly problematic).

Let's start with the claim that 'there is nowhere in Northern Europe that is as rich as London'. Unfortunately, this is not what the map shows. The map shows that INNER London has the highest GDP per capita calculated (on a PPS basis). This is three times the UK average. I find it worrying that people think this figure could possibly be correct. Of course, it's not for reasons that are a little, but not very, technical.

To see why this is a problem you need to know a little about how these statistics are calculated and something about the slightly weird geography of EU NUTS2 regions (on which the map is based). The GDP per capita figures allocate output on a workplace basis but population on a residence basis

The crucial issue is that Inner London is an administrative construct, not an economic one. That means that there is lots of commuting across the border of Inner London and, as the original data source makes very clear, "in some regions the GDP per capita figures can be significantly influenced by commuter flows. Net commuter inflows in these regions push up production to a level that could not be achieved by the resident active population on its own". That explains why the London figure looks so crazily high - because it ignores all the commuters who help produce inner London's output.

This is a bigger issue for Inner London than for some other rich EU areas. For example, according to the EU data that are used for this map, London has a population of 3m. In contrast, the Ile de France region has a population of 11m. All of this means that sensible comparisons need to correct for commuting - which I'll do the easy way by simply averaging Inner and outer London. This puts it on a par with Paris (at around 180% of the EU average) but below Luxembourg, Brussels and Hamburg. Of course, some of those regions probably need correcting to - but my point is that the data vastly overestimates London's income - and that you'd want to take account of that before reaching conclusions that 'nowhere is as rich as London'.

Next, is it the case that the UK is much more unequal than all other countries on this map? Here, the answer from the academic literature is that we are certainly more unequal. Whether we are much more unequal is open to debate. Regardless, does this level of inequality explain why the UK has the poorest 10 regions in this selection of Northern countries? It plays a part, but so too does the fact that we also have the lowest average GDP per capita (on a PPS basis). Indeed, the UK average level of income would rank it lower than the poorest Swedish region, poorer than all but a handful of Austrian, Finnish, Danish and Dutch regions (I count 6 in total) without any need to take in to account the level of inequality. In short we have lots of regions in the bottom 10 because we have both lower average income and higher inequality. There's no clean answer as to how much of this map is explained by low average income versus higher inequality. You could think of ways to try to get at it - taking, say, the level of inequality in other countries and applying it to the UK - but you certainly can't identify the separate role of average income and inequality on the basis of the map alone.

If you want an analogy, this is little like taking a primary school, finding that the ten smallest kids are in year one and attributing this to inequality amongst five year olds. [I'd be surprised to see hundreds of people retweeting that study].

One final issue is the use of GDP per capita in PPS. As the statistical note states: "GDP does not measure the income ultimately available to private households in a region" so I am not quite sure in what sense the map even shows 'poorest' and 'richest' regions. Worse, the PPS calculation is done at national, not local level. So this comparison is on nominal not real standards of living - so completely ignores the fact that London is a very expensive city relative to most other EU regions (including those in the UK).

In short, the map is a pretty misleading visual aid. Of course, we all use these kind of tricks to get people talking about important issues (like spatial disparities in the UK). The danger here, however, is that an awful lot of people (some of whom should know better) seem to take this map as showing that 1) London is the richest region in the EU; 2) High inequality explains why we have the poorest regions in Northern Europe. Unfortunately it does nothing of the kind.

Friday, 5 September 2014

Garden Cities

[Posted by Prof Henry G. Overman]

I'm fairly ambivelant about Garden Cities. We clearly need additional housing. The idea of finding some fast growing urban area, taking a bit of greenbelt land and building decent housing on it with good transport links and open spaces would probably help (such a suggestion won the Wolfson Prize). Whether it's the solution to our housing supply problems is another matter. I'd certainly want to see whether such a development proved attractive to people in general (rather than to the people who designed it) before rolling it out across the country. I'm also a believer in properly incentivising local people to agree to development - so I don't like the idea of a blue print that we'd impose on lots of places.

However, while I may be ambivelant about Garden Cities, I find our housing minister's response to the Wolfson Prize deeply depressing. According to the Independent: "the Housing minister, Brandon Lewis, has now condemned the scheme as “urban sprawl” that would build nothing other than “resentment” among local people and has said the Government would have nothing to do with it."

We have to stop this knee jerk reaction - that anything built on the green-belt is urban sprawl - if we are going to have a proper debate about increasing housing supply. Historically, towns and cities have had to accomodate some of their growth by expanding outwards. A sensible housing policy would allow for this, while also ensuring that huge amounts of countryside are not swallowed up by very low density housing (the real urban sprawl that we see in so many US cities)*. You would hope that a sensible housing minister would recognise this and try to do more to encourage considered debate about how to meet our housing needs. On the basis of his reported comments (assuming accurate) our current housing minister fails that test.

--

* Interestingly, even in the US, some of the claims about urban sprawl may be overstated. For example, in a 2005 paper in the Quarterly Journal of Economics we found little evidence that urban sprawl was increasing at the metro level. Using remote-sensing data to track the evolution of land use on a grid of 8.7 billion 30 × 30 meter cells, we measured sprawl as the amount of undeveloped land surrounding an average urban dwelling. Our findings suggested that the extent of sprawl remained roughly unchanged between 1976 and 1992 (although it varied dramatically across metropolitan areas). Of course, new development does tend to be less dense. But when you zoom out to the metro level you find that infilling of what used to be the urban fringe tended to leave a very similar pattern of development - just one that occured on a larger scale to house new population.

I'm fairly ambivelant about Garden Cities. We clearly need additional housing. The idea of finding some fast growing urban area, taking a bit of greenbelt land and building decent housing on it with good transport links and open spaces would probably help (such a suggestion won the Wolfson Prize). Whether it's the solution to our housing supply problems is another matter. I'd certainly want to see whether such a development proved attractive to people in general (rather than to the people who designed it) before rolling it out across the country. I'm also a believer in properly incentivising local people to agree to development - so I don't like the idea of a blue print that we'd impose on lots of places.

However, while I may be ambivelant about Garden Cities, I find our housing minister's response to the Wolfson Prize deeply depressing. According to the Independent: "the Housing minister, Brandon Lewis, has now condemned the scheme as “urban sprawl” that would build nothing other than “resentment” among local people and has said the Government would have nothing to do with it."

We have to stop this knee jerk reaction - that anything built on the green-belt is urban sprawl - if we are going to have a proper debate about increasing housing supply. Historically, towns and cities have had to accomodate some of their growth by expanding outwards. A sensible housing policy would allow for this, while also ensuring that huge amounts of countryside are not swallowed up by very low density housing (the real urban sprawl that we see in so many US cities)*. You would hope that a sensible housing minister would recognise this and try to do more to encourage considered debate about how to meet our housing needs. On the basis of his reported comments (assuming accurate) our current housing minister fails that test.

--

* Interestingly, even in the US, some of the claims about urban sprawl may be overstated. For example, in a 2005 paper in the Quarterly Journal of Economics we found little evidence that urban sprawl was increasing at the metro level. Using remote-sensing data to track the evolution of land use on a grid of 8.7 billion 30 × 30 meter cells, we measured sprawl as the amount of undeveloped land surrounding an average urban dwelling. Our findings suggested that the extent of sprawl remained roughly unchanged between 1976 and 1992 (although it varied dramatically across metropolitan areas). Of course, new development does tend to be less dense. But when you zoom out to the metro level you find that infilling of what used to be the urban fringe tended to leave a very similar pattern of development - just one that occured on a larger scale to house new population.

Thursday, 21 August 2014

Foreign buyers and property markets

[Posted by Prof Henry G. Overman]

In May last year, I did some back of the envelope numbers on the role of foreign buyers in driving the London property market. On the basis of a very quick calculation I concluded that "domestic sources of demand (including from first time buyers) are much more important in understanding the overall London property market than a small number of rich foreigners."

I haven't revisted these numbers, but was interested to read the following in Thomas Piketty's Capital (p463-4):

--

The rich countries are not about to be taken over by the poor countries, which would have to get much richer to do anything of the kind, and that will take many more decades.

What then, is the source of this fear, this feeling of dispossession, which is partly irrational? Part of the reason is no doubt the universal tendency to look elsewhere for the source of domestic difficulties. For example, many people in France believe that rich foreign buyers are responsible for the skyrocketing price of Paris real state. When one looks closely at who is buying what type of apartment , however, one finds that the increase in the number of foreign (or foreign-resident) buyers can explain barely 3 percent of the price increase. In other words, 97 percent of today's very high real estate prices are due to the fact that there are enough French buyers residing in France who are prosperous enough to pay such large amounts for property.

--

This is certainly in line with my priors but I'd love to see similar calculations for London.

[The source for the precise 3% figure is a PhD thesis that proved to be beyond my (miserable) French - I'm not aware of anything similar for London].

In May last year, I did some back of the envelope numbers on the role of foreign buyers in driving the London property market. On the basis of a very quick calculation I concluded that "domestic sources of demand (including from first time buyers) are much more important in understanding the overall London property market than a small number of rich foreigners."

I haven't revisted these numbers, but was interested to read the following in Thomas Piketty's Capital (p463-4):

--

The rich countries are not about to be taken over by the poor countries, which would have to get much richer to do anything of the kind, and that will take many more decades.

What then, is the source of this fear, this feeling of dispossession, which is partly irrational? Part of the reason is no doubt the universal tendency to look elsewhere for the source of domestic difficulties. For example, many people in France believe that rich foreign buyers are responsible for the skyrocketing price of Paris real state. When one looks closely at who is buying what type of apartment , however, one finds that the increase in the number of foreign (or foreign-resident) buyers can explain barely 3 percent of the price increase. In other words, 97 percent of today's very high real estate prices are due to the fact that there are enough French buyers residing in France who are prosperous enough to pay such large amounts for property.

--

This is certainly in line with my priors but I'd love to see similar calculations for London.

[The source for the precise 3% figure is a PhD thesis that proved to be beyond my (miserable) French - I'm not aware of anything similar for London].

Tuesday, 5 August 2014

How to roll out high speed broadband in Britain

Posted by Gabriel Ahlfeldt, LSE and SERC

Across the globe, governments are looking for ways to roll out reliable and fast internet access. Broadband is central to this ambition. For example, the European Commission’s ambition is that at least 50% of European households should have Internet connections above 100 Mbit/s by 2020. In the UK, the Coalition wants superfast broadband access for 95% of households by 2017, with a particular focus on cities. That’s drawn some flak from rural communities, many of whom exist on very slow connections.

To an economist, such officially defined targets imply that governments see significant externalities from broadband provision, and that if left to markets, too many households would be left in the slow lane. However, putting a number on these spillover benefits is very hard. In turn, that leaves it unclear whether publicly subsidized improvements in broadband infrastructure really are socially desirable.

I’ve just released this research, in which my co-authors Pantelis Koutroumpis and Tommaso Valletti and I try to quantify broadband’s benefits to households. We were particularly interested in the benefit users derive from internet usage above and beyond what they pay to their internet service provider (ISP). Measuring this ‘consumer surplus’, however, is difficult because we can’t directly observe what people would be willing to pay.

To get around this, we argue that it is possible to indirectly infer the consumer surplus from property prices. In the UK every property is connected to one and only one internet delivery point - the local exchange (LE). Actual broadband speed critically depends on the distance of a property to its LE and the technology of the LE: fast connections need a property close to an LE, and for the LE to have fast hardware. All else equal, properties at such favourable locations will be more attractive and, as a result, will sell at higher prices. The value of a decent internet connection can therefore be inferred from a comparison of property prices across locations, controlling for other factors.

Econometrically, there are two challenges with this approach. Firstly, there will always be some factors that shift property values and are unobservable in the data. Secondly, neighbourhood-level changes can lead ISPs to upgrade their LEs and at the same time cause house prices to increase. Our identification strategy addresses both concerns. Our most restrictive empirical models identify the broadband premium from changes in broadband speed and house prices over time and across LE boundaries. We compare properties that are located within a couple of hundred meters, but within different LE catchment areas – see figure. Within such a small range it is unlikely that distinct changes in speed that result from different upgrades in the two different LEs will be confounded with other changes in the neighbourhood.

Using this strategy we identify the causal effect of broadband speed on property prices, from about 1m property transactions between 1995 and 2010, and three LE upgrade waves covering around 4000 exchanges. We find that property prices increase on average by about 3 per cent when internet speed doubles. Importantly, there are diminishing returns to speed. While the increase in value is even greater when starting from slow internet connections, an increase in nominal speed from 8 to 24 megabits per second raises the property value by no more than 1%.

Another main finding is that the consumer surplus differs substantially across regions. It is highest in high income areas that are highly urbanized. As an example, the consumer surplus in London is almost twice as high as in any other of the English regions, reflecting very high usage in the capital city for both work and personal reasons.

We use these estimates to compute the aggregate consumer surplus from taking all UK households on broadband to the 30 mbit/s target envisioned by the EC. Comparing the results to engineering cost estimates, we find that urban areas pass the cost benefit test by a large margin. The opposite is true for rural areas. This is partially because the benefits in these areas are lowest, and partially because the costs are highest.

These results suggest that in rural areas it makes more sense for governments to adopt less expensive fixed and mobile technologies that deliver decent and reliable speed. For urban areas, super-fast broadband is an economically viable technology. An equity issue arises, however, if all taxpayers pay for a subsidized rollout, but landlords in the targeted areas accumulate a large fraction of the benefits. A levy on landlords could help promoting the rollout of fibre while at the same time saving taxpayers’ money and reducing inequalities.

Across the globe, governments are looking for ways to roll out reliable and fast internet access. Broadband is central to this ambition. For example, the European Commission’s ambition is that at least 50% of European households should have Internet connections above 100 Mbit/s by 2020. In the UK, the Coalition wants superfast broadband access for 95% of households by 2017, with a particular focus on cities. That’s drawn some flak from rural communities, many of whom exist on very slow connections.

To an economist, such officially defined targets imply that governments see significant externalities from broadband provision, and that if left to markets, too many households would be left in the slow lane. However, putting a number on these spillover benefits is very hard. In turn, that leaves it unclear whether publicly subsidized improvements in broadband infrastructure really are socially desirable.

I’ve just released this research, in which my co-authors Pantelis Koutroumpis and Tommaso Valletti and I try to quantify broadband’s benefits to households. We were particularly interested in the benefit users derive from internet usage above and beyond what they pay to their internet service provider (ISP). Measuring this ‘consumer surplus’, however, is difficult because we can’t directly observe what people would be willing to pay.

To get around this, we argue that it is possible to indirectly infer the consumer surplus from property prices. In the UK every property is connected to one and only one internet delivery point - the local exchange (LE). Actual broadband speed critically depends on the distance of a property to its LE and the technology of the LE: fast connections need a property close to an LE, and for the LE to have fast hardware. All else equal, properties at such favourable locations will be more attractive and, as a result, will sell at higher prices. The value of a decent internet connection can therefore be inferred from a comparison of property prices across locations, controlling for other factors.

Econometrically, there are two challenges with this approach. Firstly, there will always be some factors that shift property values and are unobservable in the data. Secondly, neighbourhood-level changes can lead ISPs to upgrade their LEs and at the same time cause house prices to increase. Our identification strategy addresses both concerns. Our most restrictive empirical models identify the broadband premium from changes in broadband speed and house prices over time and across LE boundaries. We compare properties that are located within a couple of hundred meters, but within different LE catchment areas – see figure. Within such a small range it is unlikely that distinct changes in speed that result from different upgrades in the two different LEs will be confounded with other changes in the neighbourhood.

Using this strategy we identify the causal effect of broadband speed on property prices, from about 1m property transactions between 1995 and 2010, and three LE upgrade waves covering around 4000 exchanges. We find that property prices increase on average by about 3 per cent when internet speed doubles. Importantly, there are diminishing returns to speed. While the increase in value is even greater when starting from slow internet connections, an increase in nominal speed from 8 to 24 megabits per second raises the property value by no more than 1%.

Another main finding is that the consumer surplus differs substantially across regions. It is highest in high income areas that are highly urbanized. As an example, the consumer surplus in London is almost twice as high as in any other of the English regions, reflecting very high usage in the capital city for both work and personal reasons.

We use these estimates to compute the aggregate consumer surplus from taking all UK households on broadband to the 30 mbit/s target envisioned by the EC. Comparing the results to engineering cost estimates, we find that urban areas pass the cost benefit test by a large margin. The opposite is true for rural areas. This is partially because the benefits in these areas are lowest, and partially because the costs are highest.

These results suggest that in rural areas it makes more sense for governments to adopt less expensive fixed and mobile technologies that deliver decent and reliable speed. For urban areas, super-fast broadband is an economically viable technology. An equity issue arises, however, if all taxpayers pay for a subsidized rollout, but landlords in the targeted areas accumulate a large fraction of the benefits. A levy on landlords could help promoting the rollout of fibre while at the same time saving taxpayers’ money and reducing inequalities.

Friday, 1 August 2014

Planning supermarkets away, for less convenience and variety, higher prices and lower productivity

[By Paul Cheshire and Christian Hilber]

One of the 'joys' of putting together a serious evidence based analysis of the effects of our planning system is to have planners turn round and dismiss the results because the analysis has not evaluated the benefits of planning. This is especially true since one of us was the first – and still one of the very few – to attempt rigorously to evaluate the net effects of restrictions on land supply; and found them to be substantial and negative in terms of their welfare effects.

The issue is in reality that very powerful and dirigiste planning policies are introduced with no attempt to analyse the value of either the benefits they might generate or the costs they impose. Because it is absurd to try to claim that planning policies do not have any costs it is surely better to have a reasonable measure of what those costs are so when we evaluate benefits – whether identified quantitatively or qualitatively – we can set the benefits against their costs. Otherwise it is rather like the ‘ladies’ menu in a posh restaurant. Great claims may be made for the dishes but it is not possible to make an informed choice of what to eat unless you know that the foie gras costs £45 while the excellent artichokes are a snip for a fiver.

Just such a policy is Town Centre First (TCF). The strict version was introduced almost on a whim in 1996 with the aim of concentrating new retail development on particular sites in central locations. One of the outcomes of this policy is highly visible: small local stores – such as Tesco Expresses or Sainsbury Locals – have mushroomed in locales that are deemed to be 'town centres' according to planners. At the same time, very few large scale supermarkets – built after 1996 – can be found out-of-town, where English households increasingly decide to live (ironically, in part this suburbanization is driven by planning restrictions in urban areas that make housing in those places increasingly unaffordable). This is because of the so called ‘sequential test’ that was designed to rule out all possible sites before allowing an out-of-town site even to be considered. The ultimate outcome of this has been that it became all but impossible to develop large format out-of-town stores in England after 1996.

There are a number of obvious adverse consequences of forcing retailing into small and often awkward sites in ‘town centres’: these locations will be less convenient for suburban shoppers (an ever growing share of the population) and the smaller stores will, compared to large format out-of-town stores, be able to offer less variety, at higher prices.

Another potential cost of TCF policy could be that it lowers efficiency by forcing stores onto more awkward and difficult to manage sites in intrinsically less productive locations. A major reason for their intrinsic lower productivity is likely to be the difficulty of supplying them efficiently. Supply depots remain located with respect to the motorway system and local planners and politicians (rather than retailers) choosing store sites in ‘town centres’ is not a recipe for efficiency. It is issues such as these that we explore in an article that is forthcoming in the Journal of Economic Geography.

Using unique store-specific data from one of the four largest supermarket chains in the UK and exploiting useful variation in TCF policies between England and Scotland and Northern Ireland – where TCF policies were introduced later and much less rigorously, especially in Northern Ireland - we identify the loss of output imposed by the implementation of TCF policy in England. Also we have data on how planning restrictiveness has varied across English Local Authorities (LAs) since 1979.

Our findings are staggering. The first is that the most restrictive LAs more or less plan supermarkets away from the communities they serve. A one standard deviation increase in the restrictiveness of a LA (which would move the LA from about average to be just in the top 15% in terms of restrictiveness) reduces the probability of their being a supermarket in it by 26%. Since more restrictive LAs also restrict the size of stores, the same increase in restrictiveness reduces the chain’s floor area in the more restrictive LA by 42%. The resulting scarcity of supermarket space does mean more sales per sq ft of floor area so the chains’ sales are reduced by ‘only’ 32% for a one SD increase in local planning restrictiveness.

Turning to the direct impact of TCF policy, according to our most conservative estimate, the implementation of strict TCF policy in 1996, combined with the initial effect of tightening controls on out-of-town stores in 1988, caused a total loss of sales of some 32%. This is the total loss of output, all else controlled for, observed in an English store opened after 1996 compared to stores that opened up prior to 1988 (when retailers in England were still pretty free to choose optimal locations) - equivalent to more than a lost decade of growth in retail output.

Our analysis suggests that the gross cost of constraining retail to sites and locations chosen by planners and local politicians rather than by retailers and shoppers, has a staggering price tag attached to it, up there with the £45 foie gras. Whether the price tag is too high depends of course on the benefits forcing retail to ‘town centres’ may deliver. The declared aim of TCF has been to make cities more ‘sustainable’ and retain access to shops for those without cars. To deliver any final verdict on TCF, these alleged benefits would also need to be rigorously quantified.

As it is they are no more than claims because there is no evidence they exist. This is what we are trying to do in an ongoing project. Our still provisional findings do not suggest that TCF policies ‘deliver the goods’. What we find is that, since TCF was strictly imposed in England, adding new stores in a local shopping area reduces distances travelled for shopping in both England and Scotland, but it has done so much more in Scotland. This is not really surprising. Whereas in Scotland retailers built stores where households increasingly live and want to shop (in suburban and ‘out-of-town’ locations), in England planners and local politicians have deliberately made this much more difficult; new stores are disproportionately on sites that are less convenient for shoppers. To be sure; some shoppers will be better off. One of us does not have a car and lives near a ‘town centre’ high street. He appreciates the additional stores. However, not many households own no car and live near ‘town centres’. So, while TCF may be the equivalent of a nice meal for a few, for most of us it is probably an empty plate: or to mix our fables - emperor’s clothes. Either way it seems to have a very high price tag attached to it.

One of the 'joys' of putting together a serious evidence based analysis of the effects of our planning system is to have planners turn round and dismiss the results because the analysis has not evaluated the benefits of planning. This is especially true since one of us was the first – and still one of the very few – to attempt rigorously to evaluate the net effects of restrictions on land supply; and found them to be substantial and negative in terms of their welfare effects.

The issue is in reality that very powerful and dirigiste planning policies are introduced with no attempt to analyse the value of either the benefits they might generate or the costs they impose. Because it is absurd to try to claim that planning policies do not have any costs it is surely better to have a reasonable measure of what those costs are so when we evaluate benefits – whether identified quantitatively or qualitatively – we can set the benefits against their costs. Otherwise it is rather like the ‘ladies’ menu in a posh restaurant. Great claims may be made for the dishes but it is not possible to make an informed choice of what to eat unless you know that the foie gras costs £45 while the excellent artichokes are a snip for a fiver.

Just such a policy is Town Centre First (TCF). The strict version was introduced almost on a whim in 1996 with the aim of concentrating new retail development on particular sites in central locations. One of the outcomes of this policy is highly visible: small local stores – such as Tesco Expresses or Sainsbury Locals – have mushroomed in locales that are deemed to be 'town centres' according to planners. At the same time, very few large scale supermarkets – built after 1996 – can be found out-of-town, where English households increasingly decide to live (ironically, in part this suburbanization is driven by planning restrictions in urban areas that make housing in those places increasingly unaffordable). This is because of the so called ‘sequential test’ that was designed to rule out all possible sites before allowing an out-of-town site even to be considered. The ultimate outcome of this has been that it became all but impossible to develop large format out-of-town stores in England after 1996.

There are a number of obvious adverse consequences of forcing retailing into small and often awkward sites in ‘town centres’: these locations will be less convenient for suburban shoppers (an ever growing share of the population) and the smaller stores will, compared to large format out-of-town stores, be able to offer less variety, at higher prices.

Another potential cost of TCF policy could be that it lowers efficiency by forcing stores onto more awkward and difficult to manage sites in intrinsically less productive locations. A major reason for their intrinsic lower productivity is likely to be the difficulty of supplying them efficiently. Supply depots remain located with respect to the motorway system and local planners and politicians (rather than retailers) choosing store sites in ‘town centres’ is not a recipe for efficiency. It is issues such as these that we explore in an article that is forthcoming in the Journal of Economic Geography.

Using unique store-specific data from one of the four largest supermarket chains in the UK and exploiting useful variation in TCF policies between England and Scotland and Northern Ireland – where TCF policies were introduced later and much less rigorously, especially in Northern Ireland - we identify the loss of output imposed by the implementation of TCF policy in England. Also we have data on how planning restrictiveness has varied across English Local Authorities (LAs) since 1979.

Our findings are staggering. The first is that the most restrictive LAs more or less plan supermarkets away from the communities they serve. A one standard deviation increase in the restrictiveness of a LA (which would move the LA from about average to be just in the top 15% in terms of restrictiveness) reduces the probability of their being a supermarket in it by 26%. Since more restrictive LAs also restrict the size of stores, the same increase in restrictiveness reduces the chain’s floor area in the more restrictive LA by 42%. The resulting scarcity of supermarket space does mean more sales per sq ft of floor area so the chains’ sales are reduced by ‘only’ 32% for a one SD increase in local planning restrictiveness.

Turning to the direct impact of TCF policy, according to our most conservative estimate, the implementation of strict TCF policy in 1996, combined with the initial effect of tightening controls on out-of-town stores in 1988, caused a total loss of sales of some 32%. This is the total loss of output, all else controlled for, observed in an English store opened after 1996 compared to stores that opened up prior to 1988 (when retailers in England were still pretty free to choose optimal locations) - equivalent to more than a lost decade of growth in retail output.

Our analysis suggests that the gross cost of constraining retail to sites and locations chosen by planners and local politicians rather than by retailers and shoppers, has a staggering price tag attached to it, up there with the £45 foie gras. Whether the price tag is too high depends of course on the benefits forcing retail to ‘town centres’ may deliver. The declared aim of TCF has been to make cities more ‘sustainable’ and retain access to shops for those without cars. To deliver any final verdict on TCF, these alleged benefits would also need to be rigorously quantified.

As it is they are no more than claims because there is no evidence they exist. This is what we are trying to do in an ongoing project. Our still provisional findings do not suggest that TCF policies ‘deliver the goods’. What we find is that, since TCF was strictly imposed in England, adding new stores in a local shopping area reduces distances travelled for shopping in both England and Scotland, but it has done so much more in Scotland. This is not really surprising. Whereas in Scotland retailers built stores where households increasingly live and want to shop (in suburban and ‘out-of-town’ locations), in England planners and local politicians have deliberately made this much more difficult; new stores are disproportionately on sites that are less convenient for shoppers. To be sure; some shoppers will be better off. One of us does not have a car and lives near a ‘town centre’ high street. He appreciates the additional stores. However, not many households own no car and live near ‘town centres’. So, while TCF may be the equivalent of a nice meal for a few, for most of us it is probably an empty plate: or to mix our fables - emperor’s clothes. Either way it seems to have a very high price tag attached to it.

Monday, 28 July 2014

Time for a more rational debate on 'mixing' in new developments?

[Posted by Prof Henry G. Overman]

I may have made this point before, but I would love to see more sensible discussion of policy around mixed housing developments. I was reminded of this by the Guardian headline on Saturday about 'Poor doors' which highlighted the segregation that goes on in some of these developments. Personally, I find such stories unpleasant, but not at all surprising. If you share that sentiment surpress, for a moment, your outrage and ask yourself the following question - if the uncomfortable truth is that wealthy people don't want to mix with their poor neighbours (and can't be forced to do so) then what, exactly does this policy achieve?

The first reason for encouraging such mixing draws on the literature about neighbourhood effects. The underlying theory is that this kind of mixing improves outcomes for poorer families. Unfortunately, the empirical evidence on this is surprisingly weak. There is evidence that families do better when they live in mixed neighbourhoods. But establishing that the causality runs from mixing to better outcomes (rather than the other way round) has proved difficult. The evidence that forcing mixing at such micro-scales (e.g. within the same blocks) improves outcomes is thin to non-existant. Perhaps not surprising when you start to think about the realities of mixing as highlighted by the Guardian article.

The second reason for forcing mixed units is that it allows local authorities to extract 'development' rents from the private sector. In other words, by forcing them to provide some social housing in exchange for permission to develop you increase the supply of social housing. But mixing per se need play no part in this. Indeed, the irony is that you could increase the amount extracted from private sector developers if we didn't insist on social units being delivered in the very same development as the private sector units. This in turn would allow us to fund more social housing provision than we achieve with the current arrangements.

In short, if forced mixing at the site level doesn't deliver clear benefits and reduces the 'tax' we can extract from developers - should we persist with it?

A few decades ago, we were providing poor quality social housing on large estates, often in areas poorly served by public transport and far away from employment opportunities. We clearly do not want to see a return to that. But policy now seems to have swung to the opposite extreme where it insists on having a mix of social and private housing in every single new development. There is little strong evidence to support such a policy - which suggests that the optimal policy may lie somewhere between these two extremes. Perhaps it's time we had a sensible debate that tried to figure out where the appropriate balance might lie?

I may have made this point before, but I would love to see more sensible discussion of policy around mixed housing developments. I was reminded of this by the Guardian headline on Saturday about 'Poor doors' which highlighted the segregation that goes on in some of these developments. Personally, I find such stories unpleasant, but not at all surprising. If you share that sentiment surpress, for a moment, your outrage and ask yourself the following question - if the uncomfortable truth is that wealthy people don't want to mix with their poor neighbours (and can't be forced to do so) then what, exactly does this policy achieve?

The first reason for encouraging such mixing draws on the literature about neighbourhood effects. The underlying theory is that this kind of mixing improves outcomes for poorer families. Unfortunately, the empirical evidence on this is surprisingly weak. There is evidence that families do better when they live in mixed neighbourhoods. But establishing that the causality runs from mixing to better outcomes (rather than the other way round) has proved difficult. The evidence that forcing mixing at such micro-scales (e.g. within the same blocks) improves outcomes is thin to non-existant. Perhaps not surprising when you start to think about the realities of mixing as highlighted by the Guardian article.

The second reason for forcing mixed units is that it allows local authorities to extract 'development' rents from the private sector. In other words, by forcing them to provide some social housing in exchange for permission to develop you increase the supply of social housing. But mixing per se need play no part in this. Indeed, the irony is that you could increase the amount extracted from private sector developers if we didn't insist on social units being delivered in the very same development as the private sector units. This in turn would allow us to fund more social housing provision than we achieve with the current arrangements.

In short, if forced mixing at the site level doesn't deliver clear benefits and reduces the 'tax' we can extract from developers - should we persist with it?

A few decades ago, we were providing poor quality social housing on large estates, often in areas poorly served by public transport and far away from employment opportunities. We clearly do not want to see a return to that. But policy now seems to have swung to the opposite extreme where it insists on having a mix of social and private housing in every single new development. There is little strong evidence to support such a policy - which suggests that the optimal policy may lie somewhere between these two extremes. Perhaps it's time we had a sensible debate that tried to figure out where the appropriate balance might lie?

Monday, 14 July 2014

Improving Voter Turnout

I don't have a strong view on police and crime commissioners. But looking at a recent article on the West Midlands by election I was intrigued to notice that "the Home Office has chosen to spend an extra £1 million on a pilot programme sending publicity booklets to every household in the region in an attempt to drum up interest in one of the coalition’s flagship policing policies."

Wearing my 'what works hat' I am spending a lot of time thinking about how to evaluate different kinds of policy so I wondered what the Home Office was trying to achieve with these booklets. Jim Waterson (who authored the original article) kindly sent me a link to the legislation that explains all:

"This trial will allow the Government to evaluate whether the delivery of election booklets to residential premises significantly raises voter awareness about the candidates standing in a PCC election."